Australian Shares Stay Neutral Amid Mixed Sector Movements

11 months ago • 1 min

Join the newsletter that everyone in finance secretly reads. 1M+ subscribers, 100% free.

What’s going on here?

Australian shares traded flat on Tuesday, with gains in mining and gold stocks offset by losses in heavyweight banking stocks.

What does this mean?

The S&P/ASX 200 index barely budged at 7,785.10 after rising 0.8% on Monday. Mining stocks edged up 0.5%, with BHP Group climbing nearly 0.6%. The gold sub-index also advanced 0.9%, supported by a 1% increase in gold prices on Monday due to dwindling expectations for US rate cuts. However, interest rate-sensitive financials fell 0.2%, with Commonwealth Bank of Australia and Westpac experiencing slight declines. Healthcare and technology stocks also dipped, by 0.4% and 0.3% respectively. All eyes are now on the upcoming CPI data release, which will significantly influence the Reserve Bank of Australia's interest rate decisions.

Why should I care?

For markets: Stable yet watchful.

Investors are navigating a market where the balance between resource gains and financial sector losses has kept volatility low. The banking sector's sensitivity to potential rate changes adds a layer of complexity, particularly with critical inflation data on the horizon. Market movements could get more dynamic depending on the Reserve Bank of Australia's next policy steps.

The bigger picture: Inflation data’s pivotal role.

Australia's CPI for April is a crucial indicator that could reshape the Reserve Bank's rate policy. A slight ease from March's 3.5% to 3.4% is expected, but a higher-than-anticipated figure may prompt discussions on rate hikes. Meanwhile, New Zealand's S&P/NZX 50 index showed mild gains, with an eye toward the government's budget announcement, which is projected to reveal a worsening fiscal deficit.

Like ETFs, but for your wardrobe

It’s hard to pick the right individual stocks. It’s even harder to pick the right work shirt when the subway is sweltering hot.

So consider your wardrobe a fund and Luca Faloni the active manager. After all, the menswear company knows its way around luxurious fabrics, fine Italian craftsmanship and making investment-worthy staples.

So here are the finest shirts Luca Faloni recommends for your style portfolio:

A denim one, reimagined in a robust yet soft handle Italian denim for easy, timeless style. Cotton piqué, a breathable smart-casual choice. Poplin cotton, a crease-free office go-to. Silk-cotton, an oh-so-soft option to beat sweaty weather. Finally, a classic linen, the signature best seller for simple, refined style.

Diversify your wardrobe: take your pick (if you can bear to choose between them) here.

Did you find this insightful?

Nope

Sort of

Absolutely

TRENDING

READ NEXT

Quick Take

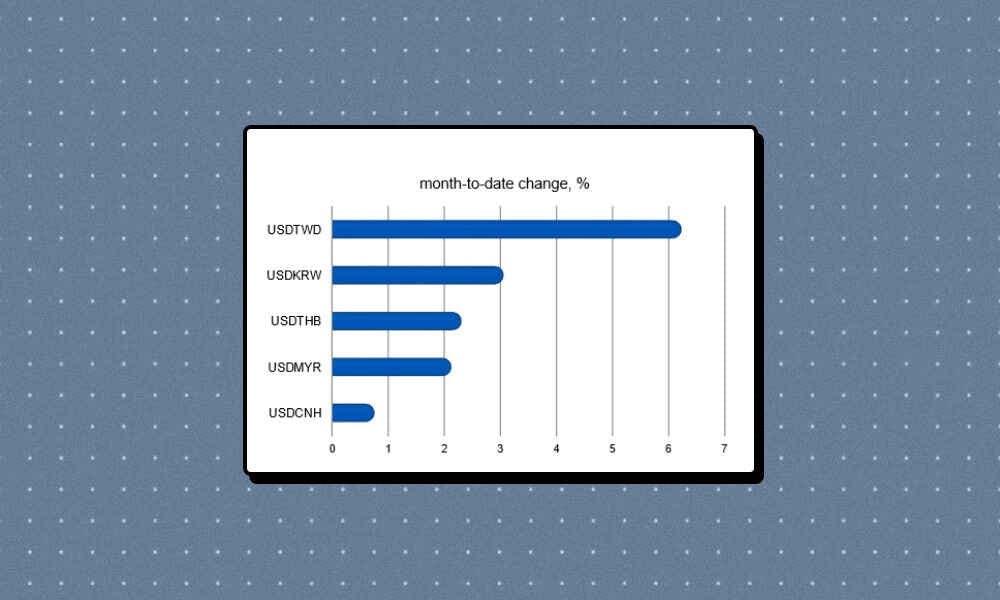

US-China Trade Talks Sparked A Rise In Asian Currencies

Aberdeen Group x Finimize • 18 minutes ago

News

Skechers Goes Private In $9.4 Billion Deal With 3G Capital

Finimize Newsroom • about 22 hours ago

Research

Coinbase’s Steep Drop Might Make It Interesting, But It Hasn’t Made It Cheap

Russell Burns • 25 Mar 2025

Research

Threats Are Rising. So Here’s How To Invest In Cybersecurity.

Theodora Lee Joseph, CFA • 11 Mar 2025

Disclaimer: These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment advisor. This article may contain AI-edited content. While efforts have been made to ensure accuracy, AI may not capture the nuances of the subject matter resulting in errors or inconsistencies.

Subscribe now for unlimited access.

You have 0 free articles left.